| ||||

| ||||

| ||||

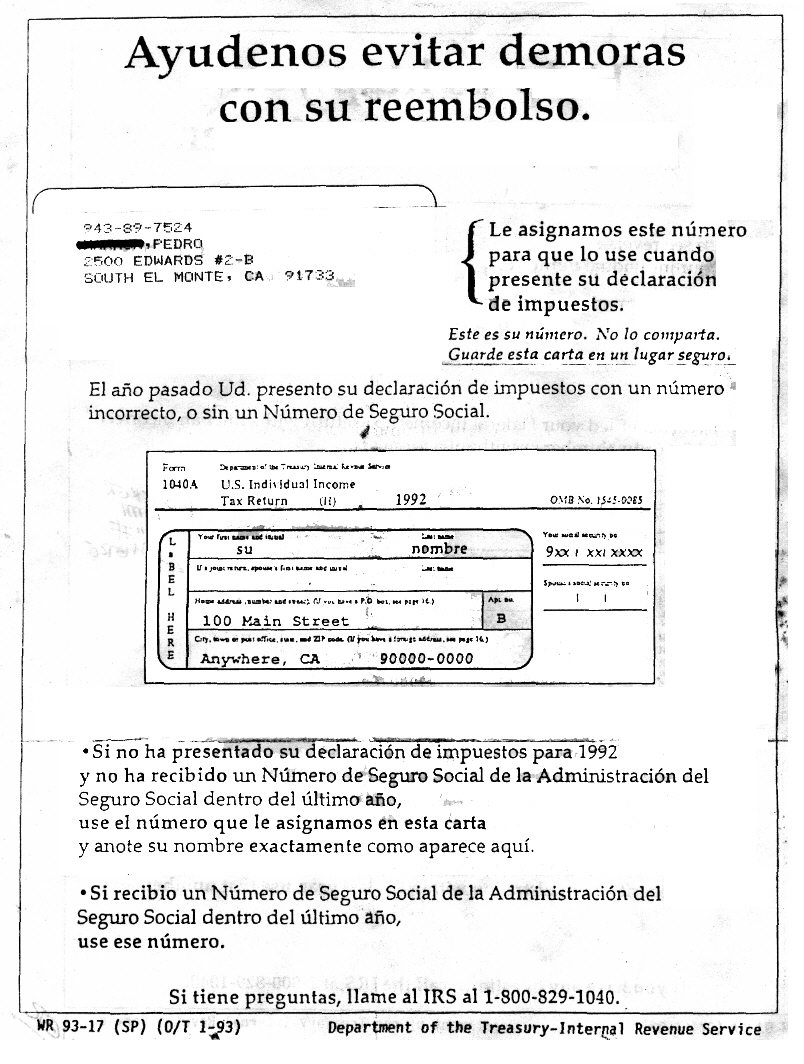

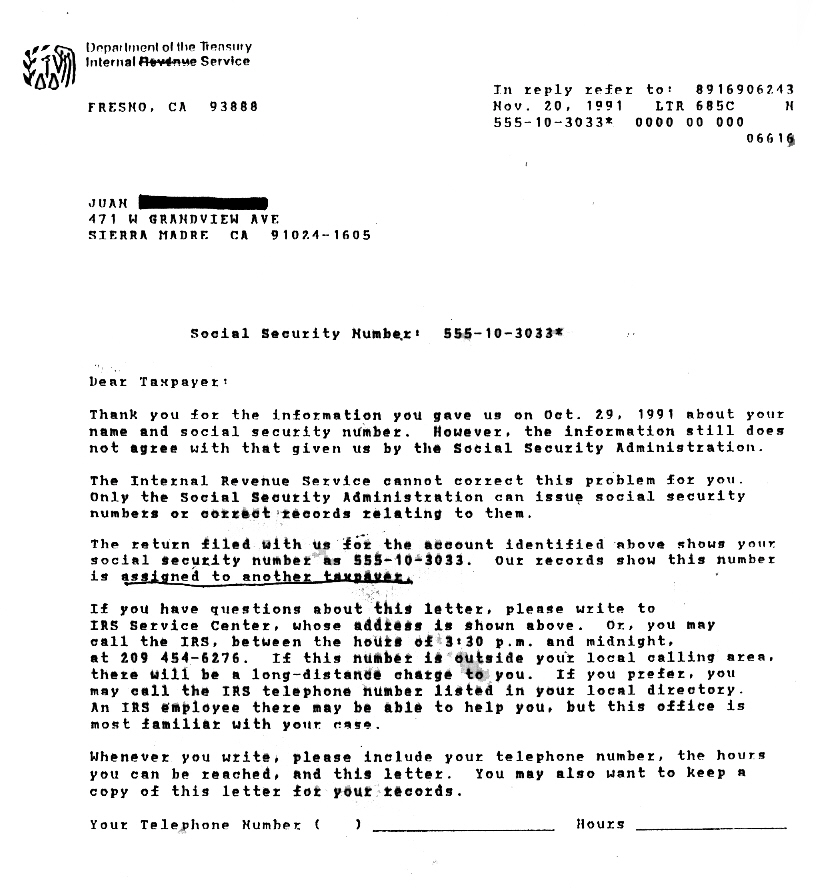

When the IRS discovered that Juan was using someone else's SSN, you would think that he would have been arrested. Instead, he received the letter below giving him an ITIN (Individual Tax payer Identification Number) as if this was just an honest mistake.

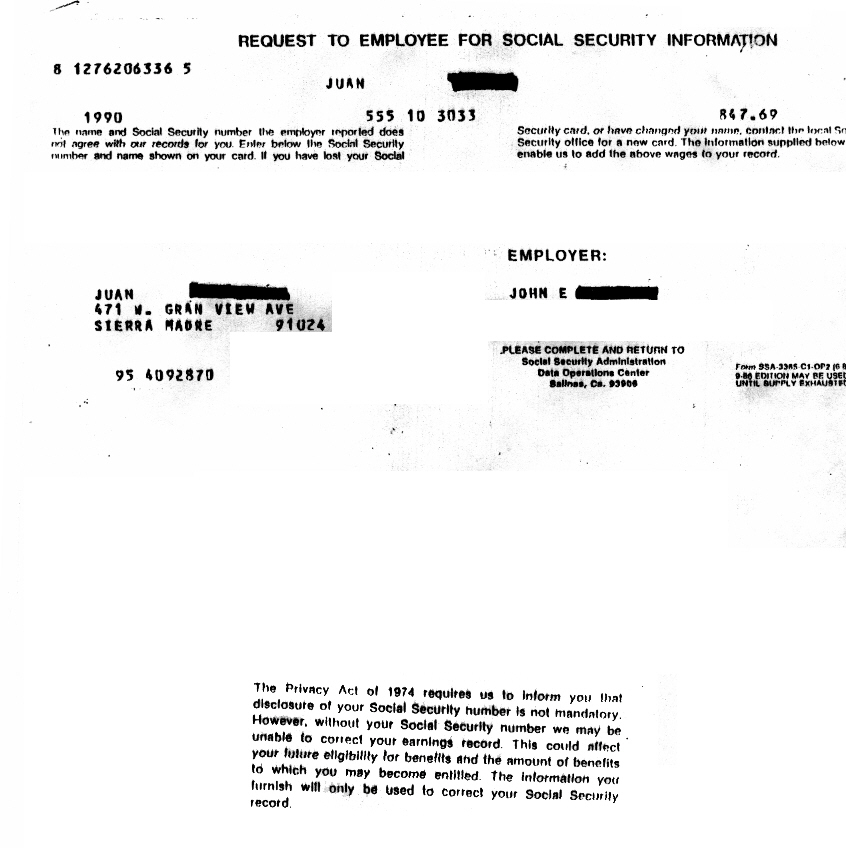

In the same letter, the next page tells Juan that he really doesn't have to go the the SS Agency, because he has a privacy right not to give out his SSN which he doesn't have in the first place (see disclaimer below).

| ||||

The Privacy Act of 1974 requires us to inform you that disclosure of your Social Security number is not mandatory. However, without your Social Security number we may be unable to correct your record. This could effect your future eligibility for benefits and the amount of benefits to which you may become entitled. The information you furnish will only be used to correct your Social Security record.

==========================================================================

This bizarre advisory pretends that the individual just made an honest mistake.

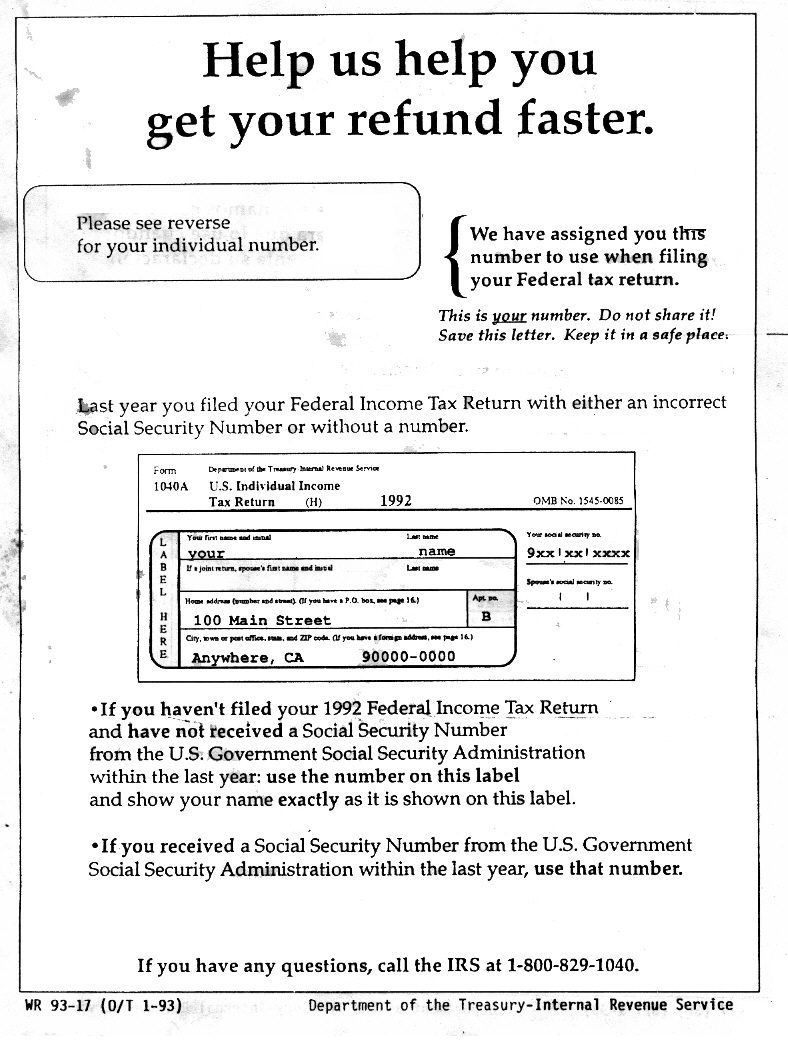

Without asking for it, Juan received his ITIN. The double sided letter offering help, has Juan's new ITIN on the Spanish side.

New ITIN

| ||||

So why doesn't the IRS report illegals using ITINs to the ICE? Because the information contained in the IRS database, is by law, not allowed to be shared with any other federal agency unless it is subpoenaed.

It gets even crazier:

All ITINs start with the number nine. It's a dead giveaway to any employer who is provided with an ITIN with the first digit "9" in place of a Social Security number, that the would-be employee is not authorized to work in the U.S.

Not only can Juan use his ITIN to file his taxes, his dependents can also obtain ITINs from the U.S. Consulate in Mexico (thanks to a tax treaty between the U.S. and Mexico). Moreover, the IRS has no way to verify that the family member is actually dependent and receiving support from the illegal alien tax payer.

The above documents are outdated, but nothing has change except that the illegal alien must now fill out an ITIN application W-7 form which must be approved at any IRS office. In order for the IRS to approve the W-7, the alien must oxymoronically prove that he has a need to pay taxes (actually a need for a refund) earned at a job he's not supposed to have in the first place. The IRS then forwards the W-7 application to their headquarters and after about eight weeks the illegal receives his ITIN in the mail.

This IRS ITIN revision explains the changes. Another change is that 13 states presently accept the ITIN in place of a SSN to obtain a valid driver's license even though the revision states in the fifth paragraph: "Earlier this year, the IRS issued letters to all governors and state motor vehicle departments advising that ITINs were not designed to serve as personal identification and would not be suitable for determining identification of applicants for driver’s licenses."

Now you know why the system is broken.

And since the IRS, SS Agency, and Homeland Security all report to the president who doesn't need congress to change the way they do things,

The president must be the one who has broken the system.

This disclaimer was rubber stamped here